How to read your financial award letter

- Amanda Merrifield

- Mar 20, 2021

- 4 min read

How exciting! You have a few offers and are considering where you’d like to live for the next four years. It’s important to consider all aspects of the college journey, including how much it will cost. A college degree is worth a lot, but not everyone can afford to the high price tag at some institutions. If you’re having trouble understanding your award letter, and don’t know where to go from here, read on.

Important Terms

Cost of Attendance (COA): A school’s cost of attendance, (COA) is the amount a school has estimated that each student needs to have to meet their basic needs. The COA usually includes average tuition and fees, room and board, transportation, and supplies. Since it is only an estimate, you may need more (or less) to actually be comfortable.

Expected Family Contribution (EFC): Based on the information your family provided in FAFSA, the government will determine your EFC or Expected Family Contribution. Your “Financial Need” is based on this score, and each institution determines what financial aid you’ll get based on this index.

Financial “Need”: Financial need is the difference between your ability to pay for college and how much it costs to attend. Your financial need is determined by subtracting your EFC from the COA.

Gift Aid: Free money!! This can come as either grants or scholarships, and you won’t have to pay it back! Ideally you will get most of your tuition covered by gift aid. You can find out how much gift aid you have on your award letter.

Work-Study: This isn’t exactly “free money”, because work-study is a part-time job program. However, it is not money you will have to pay back, and typically is good to have as part of your award package. Work-study jobs are flexible, near campus, and allow you to get some interesting work experience, too.

Student Loans: These loans are either federal or institutional, and have varying repayment plans.

Subsidized Loans: Loans that do not accrue interest while you’re at least a half-time student or while your loans are in deferment.

Unsubsidized Loans: Loans that are not based on financial need. Eligibility is determined by your cost of attendance minus other financial aid (such as grants or scholarships). Interest is charged during in-school, deferment, and grace periods.

Questions to Ask Yourself

Knowing key terms is great, and being able to read your award letter is essential, but there is more to scholarships and loans than meets the eye. When it comes to understanding which school is most affordable for you, make sure you ask yourself (and admissions officials at your accepted schools) these questions:

Scholarships

Will my scholarship renew every year?

Will it renew at the same amount?

What are my responsibilities to keep my scholarship?

Loans

What is the interest rate on the loan?

Do I have to start paying it back before I graduate, or after? How long after?

Are there any additional fees aside from the interest rate?

When will interest start accruing?

What is the length of repayment?

What will the monthly payment be?

Award Letter Breakdown

Below, we will take a look at award letters given to a student by two different universities - one private and one public. Hopefully this will allow you to see our key terms in action, and get a sense of what your award letter may look like.

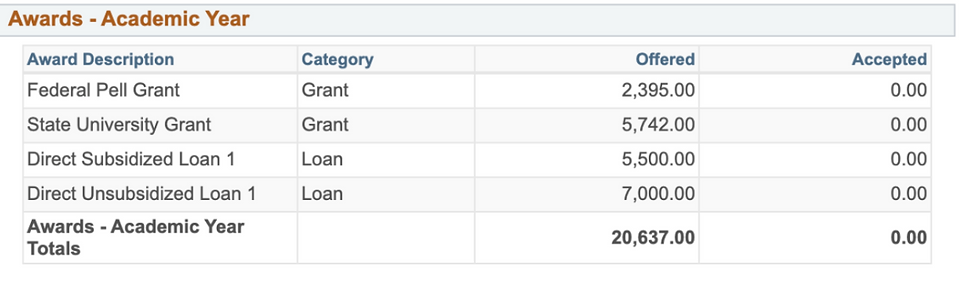

CSULB’s Award Portal

CSULB’s Cost of Attendance (COA) for a California resident living on campus: $25,052 based on their website

This letter isn’t a letter at all, but rather a screenshot from CSULB’s portal. This student received two grants, and two loans, which cover $20,000 for the total academic year. This screenshot is not broken down by semester.

So, it looks like CSULB will not cover all of the costs for this student with grants and loans. There is still approximately $5,000 not covered here, and maybe more if this student has higher living expenses than another student. It is up to the family to decide if this is a reasonable amount of money that they can afford to cover out of pocket each year.

Chapman’s Award Letter

Chapman’s Cost of Attendance (COA) for a student living on campus: $82,548 based on their website

Chapman is a private university, and to some that may come with the preconceived notion that it will definitely be more expensive. However, that isn’t always the case. Private institutions have a habit of handing out more grants than public institutions, and sometimes covering the costs entirely. Based on the information below, we can see that Chapman is offering four grants, covering more tuition than CSULB’s options! They are still offering loans, but there are significantly less loans offered by Chapman than by CSULB. Chapman is also offering this student $3000 in Federal Work Study, which is not offered at CSULB.

The total amount offered in grants, loans and work-study? $45,529!

That’s a serious chunk of change! But is it enough to cover all the costs? No, it isn’t. Chapman’s COA is $82,000/year. If the student wants to make this affordable, the family will likely have to find an alternative route to pay for the remaining balance. I recommend working with a financial advisor to find the right balance per family.

Related Posts

See AllHow the Waldorf High School curriculum may cause potential parents to put breaks on enrollment.

Comments